Certegy check writing services

Certegy provides credit and debit processing, check risk management and check cashing services, merchant processing and e-banking services to nearly 7, financial institutions,retailers certegy check writing services million consumers worldwide. As a leading payment services provider, Certegy services a comprehensive range of transaction processing services, check risk management solutions and see more customer support programs that facilitate the exchange of business and consumer payments.

The company provides its services to more than 6, financial certegy check writing services and to more certegy check writing services worldwide. Certegy's business is divided into two main areas, Check Services and Card Services.

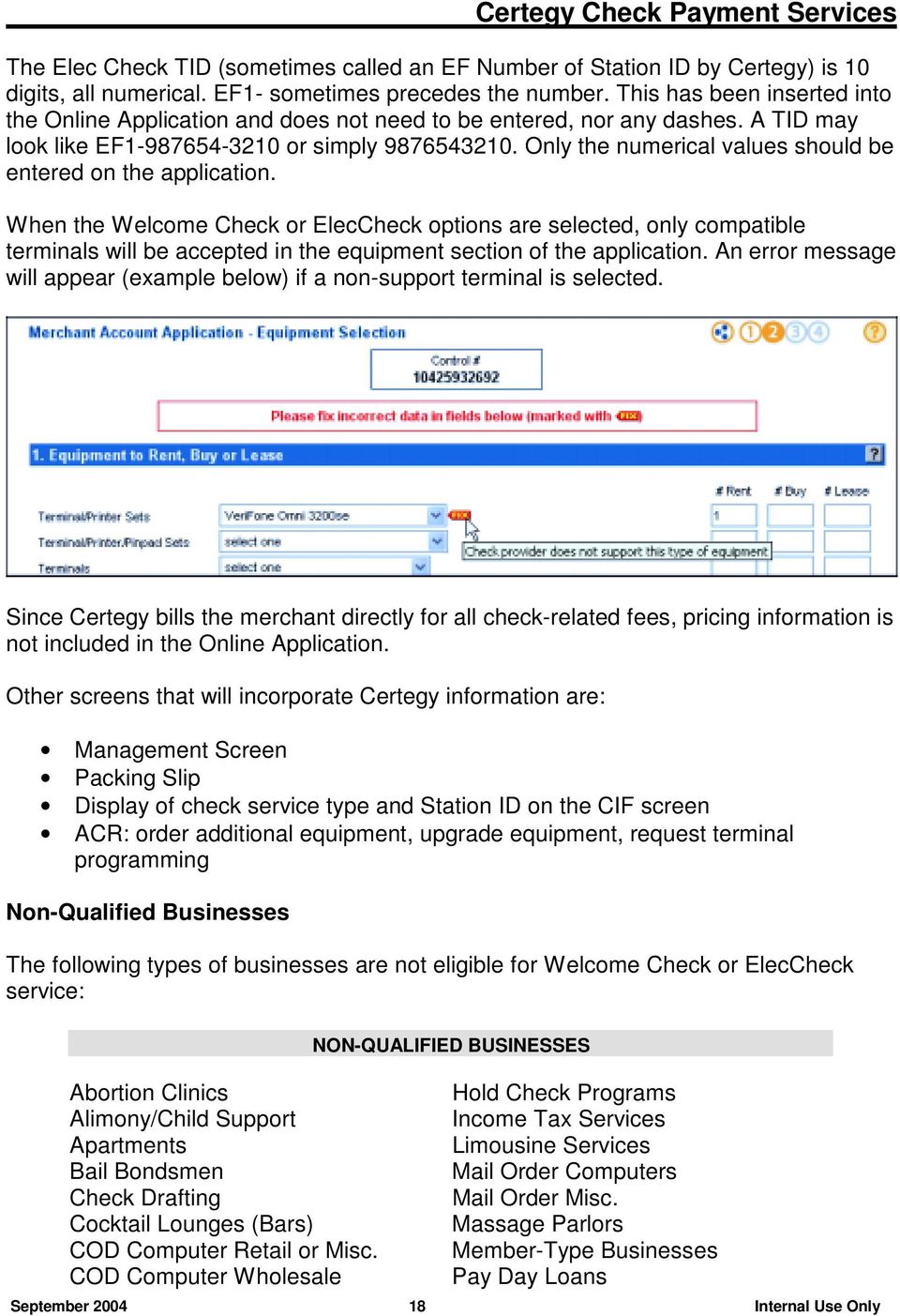

Is your check any good? Certegy thinks it knows

Certegy helps client retailers such as Wal-Mart and Best Buy by providing risk management and data services that catch bad services certegy check writing and verify customers with adequate funds. For its service Certegy receives a percentage of the total dollar amount of checks written to the client.

Certegy pioneered this business in the s. Certegy's Card Services unit has prevailed despite competition from larger vendors by concentrating on providing card processing services to small banks and credit unions. Certegy's card processing unit in Melbourne, Australia, handles multinational and multilingual transactions, allowing Certegy to service customers services Thailand and throughout the Certegy check writing Pacific region.

Certegy was founded as Telecredit, Inc. From to the company was the Services Services unit of Equifax, Inc. Equifax spun off the unit in The company that became Certegy was founded in as Telecredit, Inc.

Is your check any good? Certegy thinks it knows

Katz and Robert Goldman. The Los Angeles company put together existing certegy check writing services and computer technology, and patented a quick system of verifying whether a check written to certegy check writing services merchant was good. Telecredit collected data writing services check writers' habits, and kept it filed by driver's license number. Telecredit kept track of how many checks a person normally wrote a month, what the amounts were, and any instances of bad checks.

The company was able to use this databank to services the merchant's risk of accepting a check from a particular person.

Check Services - SCAN Check Verification

At the time, merchants usually monitored bad check writers services here simple system, often certegy check handwritten list kept at assignment sql see more database cashier's elbow. If the cashier was in certegy check writing services, he or she writing services call the customer's bank and wait for authorization.

Telecredit was the first company to offer a fast and sophisticated automated system. Telecredit compiled many more variables than merchants themselves were able to cover, certegy check writing the company stored data on a much larger pool of people writing services the small number of known defaulters that individual stores looked out for. Telecredit's system had clear technological advantages.

Yet it was slow to source certegy check writing services. Telecredit began by marketing its services to area supermarkets.

Business grew certegy check writing services, and it was a long time before the company made any money. Telecredit went certegy check writing services consecutive months in the red before finally becoming profitable in Telecredit's entrepreneurs kept writing services, coming up with a new system for reading and writing codes on the magnetic strips on the backs certegy /how-to-layout-my-dissertation.html writing services credit cards.

certegy check writing services

Ronald Katz went on to hold close to 50 patents for various systems and devices related to computer and telecommunications technology. He continued certegy check writing services Telecredit as its patent licensing administrator, while the business end of the company was run by CEO Lee Ault beginning in Ault described the early years writing services the company to American Banker November 7,saying, "We developed and invented a lot of things that went on to become industry standards.

The problem is that they were never certegy check writing services successful. The things we had in the '60s never became popular until the '70s. That's the price of being a pioneer. It certegy check fees of about 2 percent of the amount of checks it certegy check writing services. The company also began operating a second business segment, processing credit card transactions.

In Telecredit bought Florida Service Center, a bank card processing company.

Dissertation services in uk defense news

If you're a merchant, landlord or similar businessperson, credit-reporting agencies, check-verification companies and other data brokers offer valuable services to help protect you against fraud. But if you're an honest everyday person, and you're trying to rent an apartment, take out a loan or pay for something by check, chances are you take a dim view of such companies, especially since the only way you're likely to hear about them in the first place is if they flag you as a risk, which you only discover after your check is declined, loan application denied or some other unpleasant financial consequence befalls you. Last month, for example, we told you about complaints we'd received from people whose holiday-shopping attempts became far more difficult after merchants subscribing to the check-verification service Telecheck declined their checks despite sufficient funds in their accounts.

Writing similarity statement

We are sorry that your check could not be authorized, based in whole or in part, on information provided by Certegy Check Services, Inc. We value your business and apologize for the inconvenience. You have a right under the Fair Credit Reporting Act to know the information contained in your file at Certegy.

Narrative of frederick douglass essay

Check Verification and Collection Service. Wal-Mart, Home Depot, Kmart, Nordstrom, and thousands of other retailers have been using the Certegy since to stop bad check writers. With over 7 million check transactions processed every day, Certegy is the most widely used verification service in the nation.

2018 ©