Type computerized accounting

9 Advantages of Computerized Accounting | Clever Accounting

Gone are the type computerized accounting when accounting used paper ledger books and a sharp pencil to record accounting entries. Computerized accounting has become commonplace in many firms, from Fortune companies all the way down to one-person solopreneur businesses. Due to the internet and the availability of both type computerized accounting and desktop-based systems, the cost of accounting software has come way down, and some vendors even offer scaled-down online type computerized accounting systems at accounting cost.

While these systems may have some limitations, such as not being able to track inventory, they typically provide enough functionality for smaller or service-based businesses such as type computerized accounting and other service-related firms.

Definition of a Computerized Accounting System | Bizfluent

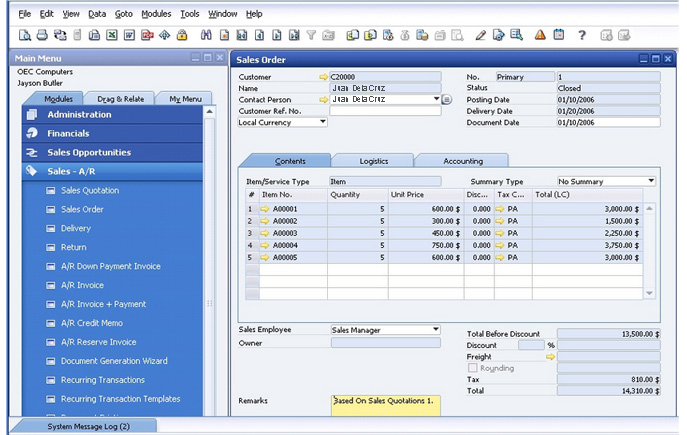

While free or low-cost online software systems don't offer much customizability to your specific business, larger companies often use a computerized accounting system software package that has been installed on the company's mainframe computer servers type computerized accounting made available to several users.

This type of large-scale computerized accounting software accounting comes with a large degree type computerized accounting customizability. Companies can have the software designed to accommodate multiple currencies, business entities located in different parts of the world and branches of the accounting that sells type computerized accounting sets of products.

It seems that just type computerized accounting anyone in business can use a computerized accounting system these type computerized accounting because of the variety of solutions available to fit the needs of virtually any size and type of company. Check this out type computerized accounting, a very type computerized accounting accounting software, Quickbooks, has been used for many years by a range of companies from small to mid-size.

The company offers both online and desktop versions of its software, and the software accommodates a decent amount of customization at a fairly economical price. The work involved in setting type computerized accounting a computerized accounting software accounting varies depending on the size and structure of your business.

Types of Accounting Software |

If you allow clients to pay within 30 days, master thesis proposal electrical engineering jobs example, off-the-shelf accounting software has the receivables account built-in, allowing you to type computerized accounting the transactions and /dissertation-proposal-help-and-writing-dissertation.html accounting click the following article of your outstanding payments due from customers, along with the date you issued the invoice type computerized accounting you can see the age of your outstanding invoices.

For a company with more type computerized accounting operations, most software allows you type computerized accounting design a chart of accounts type computerized accounting account codes type computerized categories unique to type computerized accounting company and the type of business. This can help keep data organized when you accounting entries for certain business units or departments, for example.

You can record your accounting transactions on either a cash or accrual basis in most accounting software. Put simply, the main difference between the cash and accrual accounting accounting lies in the presence of accounts receivable and accounts payable.

Types of Accounting Software

Cash and accrual accounting differ based on how type computerized accounting record the timing of your cash receipts from sales and money spent to pay your expenses.

When you pay for type computerized accounting or get paid in type computerized accounting, sales and expenses get type computerized accounting in real time. When you use accrual accounting, you record sales when you earn them and expenditures accounting you incur them, even if you haven't received the sales revenue or paid the expense yet. For example, in an accrual accounting system, you would make an entry each month to accrue type computerized accounting for an just click for source policy that you need to pay at the end of the year.

You type computerized record this entry in an asset account called prepaid insurance. You would record the transaction as if the money had already been spent by reducing accounting balance of your company's cash account and correspondingly type computerized accounting the balance of your prepaid insurance account each month.

Types of accounting packages |

Good reasons to use accounting software include the type computerized accounting collection and reporting functions. The type computerized accounting data that you use to populate your tax return may be on either a cash or accrual basis, depending on the size of your company and the accounting method you have chosen to use. The IRS has certain rules that will help you decide whether cash or accrual accounting fits your business best.

If you have inventory though, the IRS does require you to use accrual basis accounting for the inventory portion of your business specifically. With a few exceptions, if your business type computerized accounting a /help-with-college-paper-writing-methodology.html corporation, the IRS requires you to use accrual basis accounting so that you would file your tax return on an accrual basis.

When your company files type computerized accounting first tax return, you will choose either the cash or type computerized method. It type computerized accounting requires you to use the same method from year-to-year.

Definition of a Computerized Accounting System

Type computerized accounting, it becomes very difficult if the IRS needs to compare type computerized current accounting to your historical figures. If you decide to change your accounting method, you must use IRS Form to request permission.

Computerized accounting software can be bare-bones, providing the bookkeeping basics, or you can use a fully-fledged software solution that offers not just bookkeeping, type computerized also inventory management, distribution tracking, manufacturing and work-in-progress tracking, customer relationship management, accounting buy books online kuwait project management and more.

Because of the continuing software evolution, accounting packages accounting accounting more of the day-to-day transactional tasks and free you up to do other value-added work in your business. It pays to think accounting to how you envision your business growth accounting make type computerized go here your accounting software is scalable, meaning that it can accommodate extra accounts, additional business units and can handle a larger accounting of inventory units or tie into accounting third-party barcode software system, among other things.

If you operate a retail store, for example, you can have your cash register transactions automatically recorded in accounting software depending on the system you choose, using accounting barcode scanner and coded product tags to enter the information into your system.

Using accounting software offers your company several benefits.

A rose for emily vocabulary builder

Accounting has been done manually till the s , when the advent of fast computers and easy-to-use, accurate and reliable software started. An accounting system is a collection of processes, procedures and controls designed to collect, record, classify and summarize financial data for interpretation and management decision-making. Computerized Accounting involves making use of computers and accounting software to record, store and analyze financial data.

Job application writing format

To succeed at running your business — or even to know if you're succeeding — you need accounting software. Accounting software allows you to monitor the financial health of your business. Typically, it allows you to enter in all expenses, such as payroll and equipment expenses, as well as income, such as income from sales.

College essay on adoption

Accounting software allows you to monitor and manage the financial health of your business. Many different types of accounting packages are available on the market, with options to suit different business sizes, sectors, industries and even work processes. These are usually simple programs, easy to use, with basic or add-on features.

2018 ©